Don’t miss this

Pre-Black Friday Special

for just $79!

November 12, 8pm EST | 7pm CST

Avoid $30,000 in Penalties With the Right Notes, Questions & Systems

Learn exactly what the IRS is looking for and how to have it ready every single time

Worried About IRS Warnings Letters and Confused About Tax Pro Due Diligence Requirements?

Our Tax Pro Due Diligence Training is Designed

Just for You!

Worried About IRS Warnings Letters and Confused About Tax Pro Due Diligence Requirements?

Our Tax Pro Due Diligence Training is Designed Just for You!

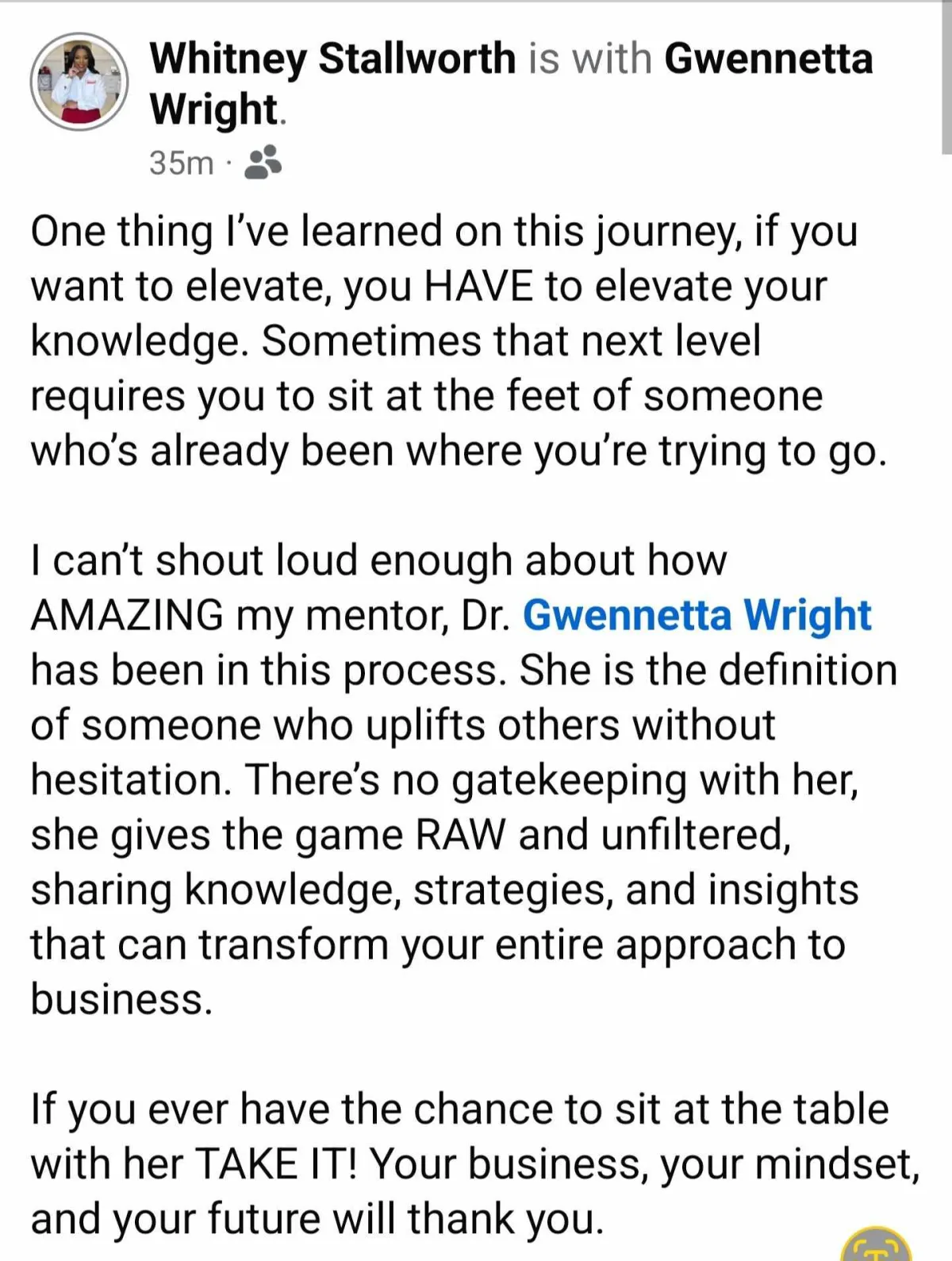

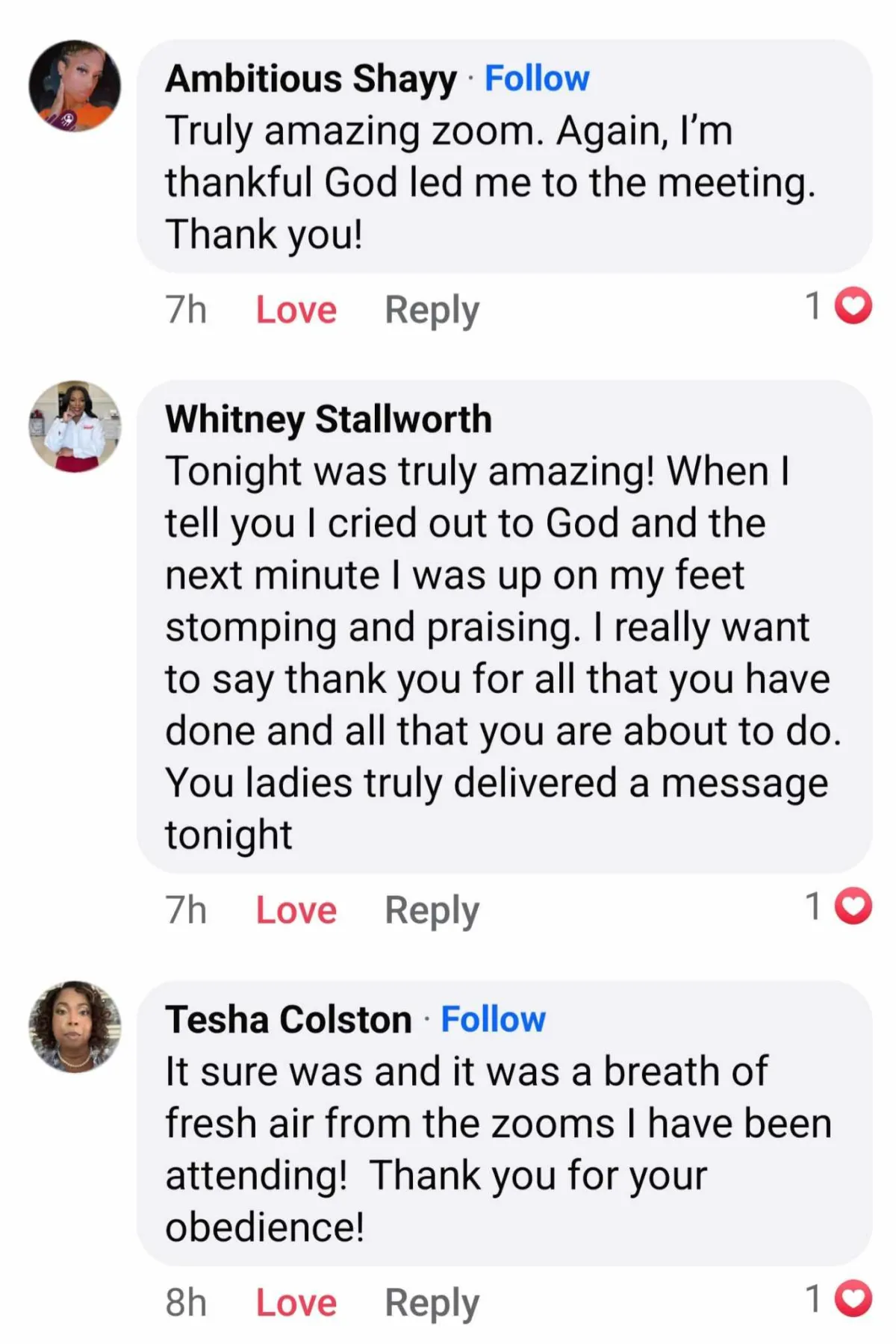

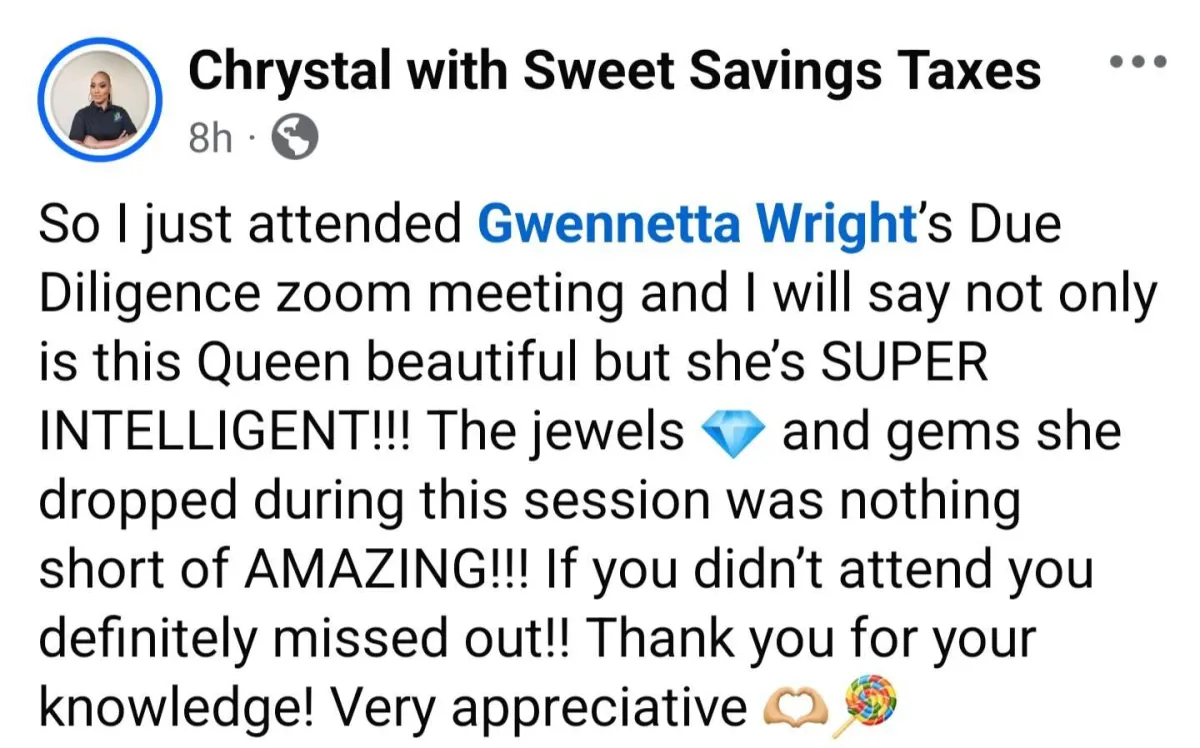

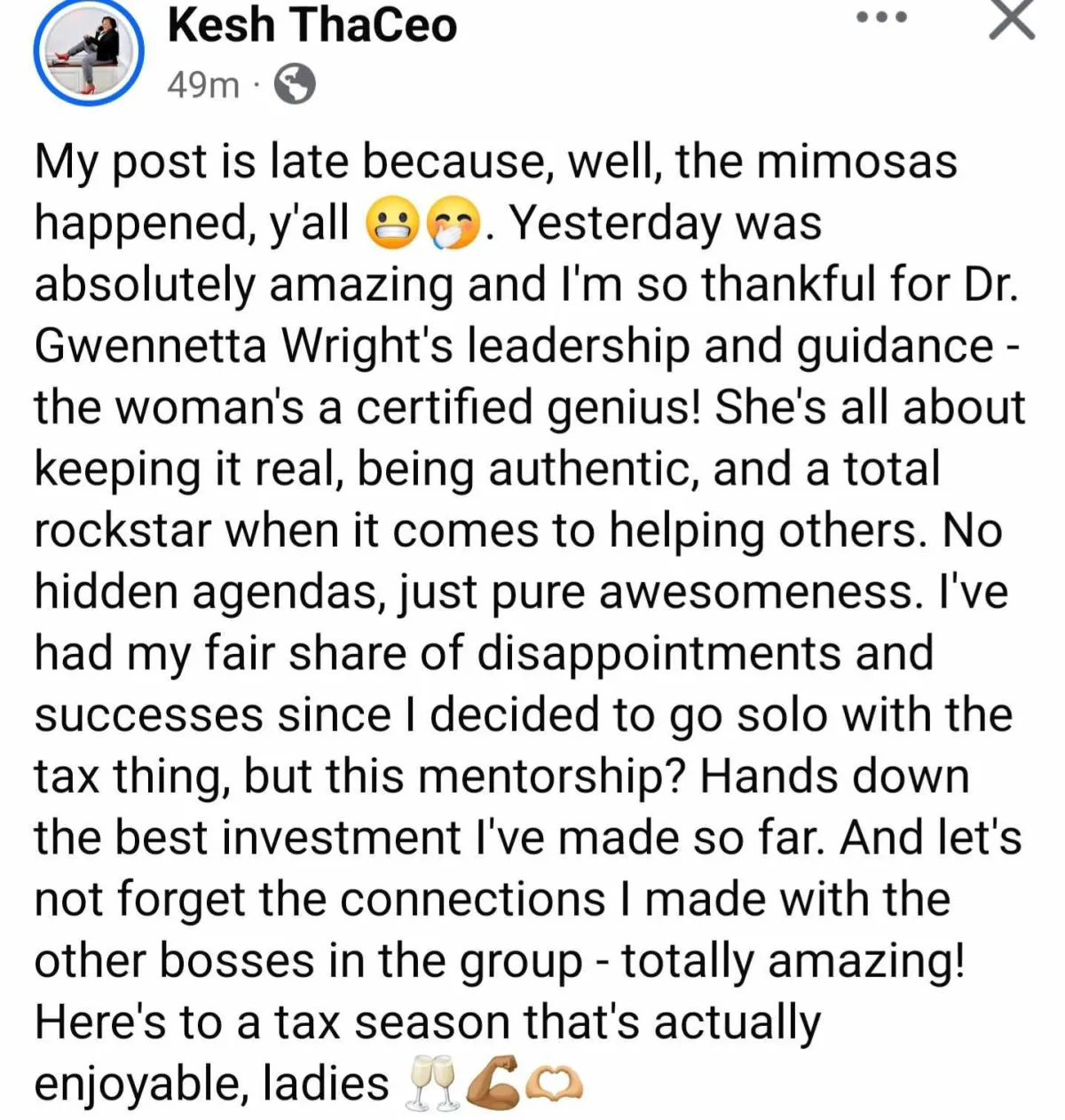

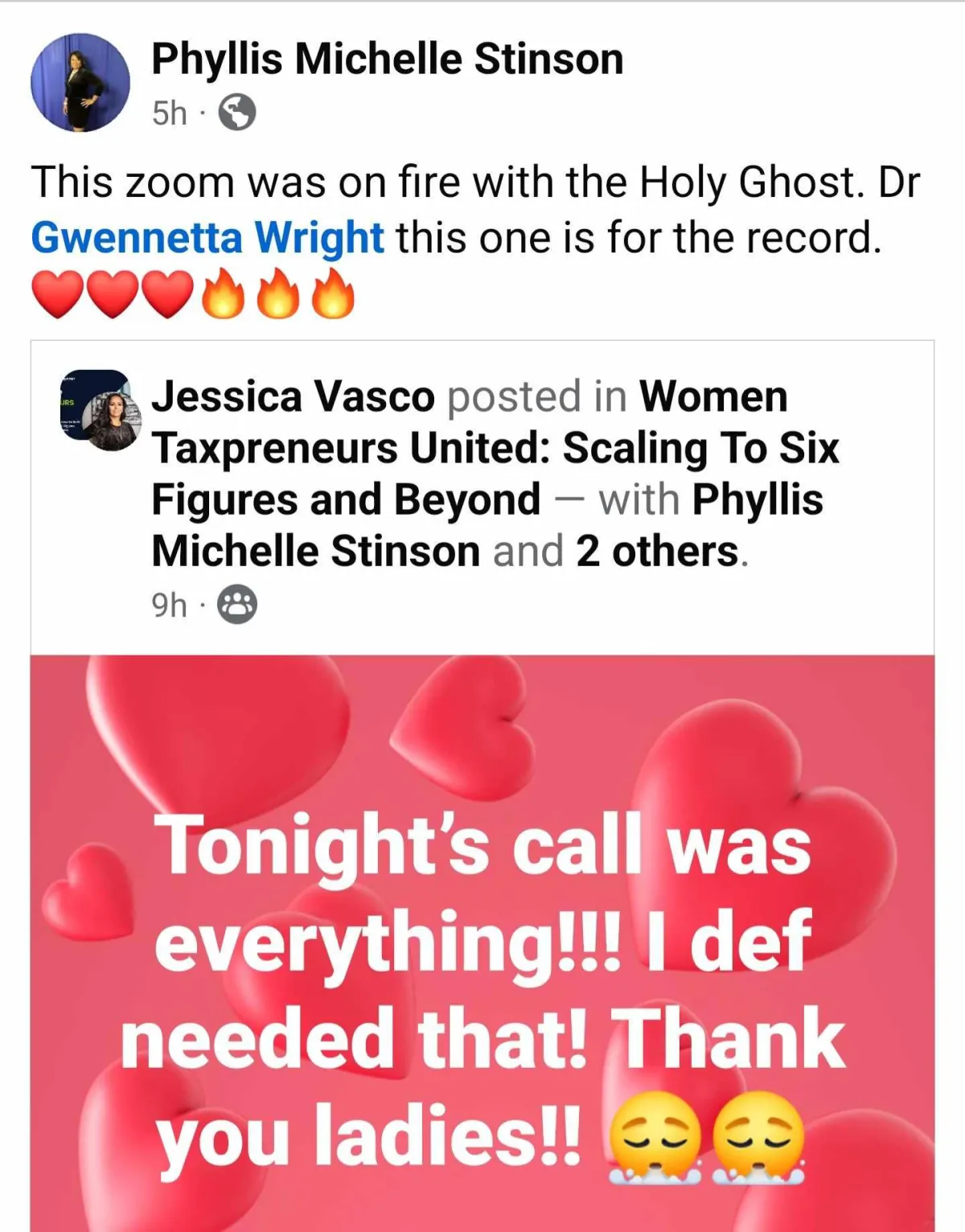

TESTIMONIALS

What others are saying

"Simply the best!"

You really did your big one! The best one I've been to so far

- Monisha Braggs

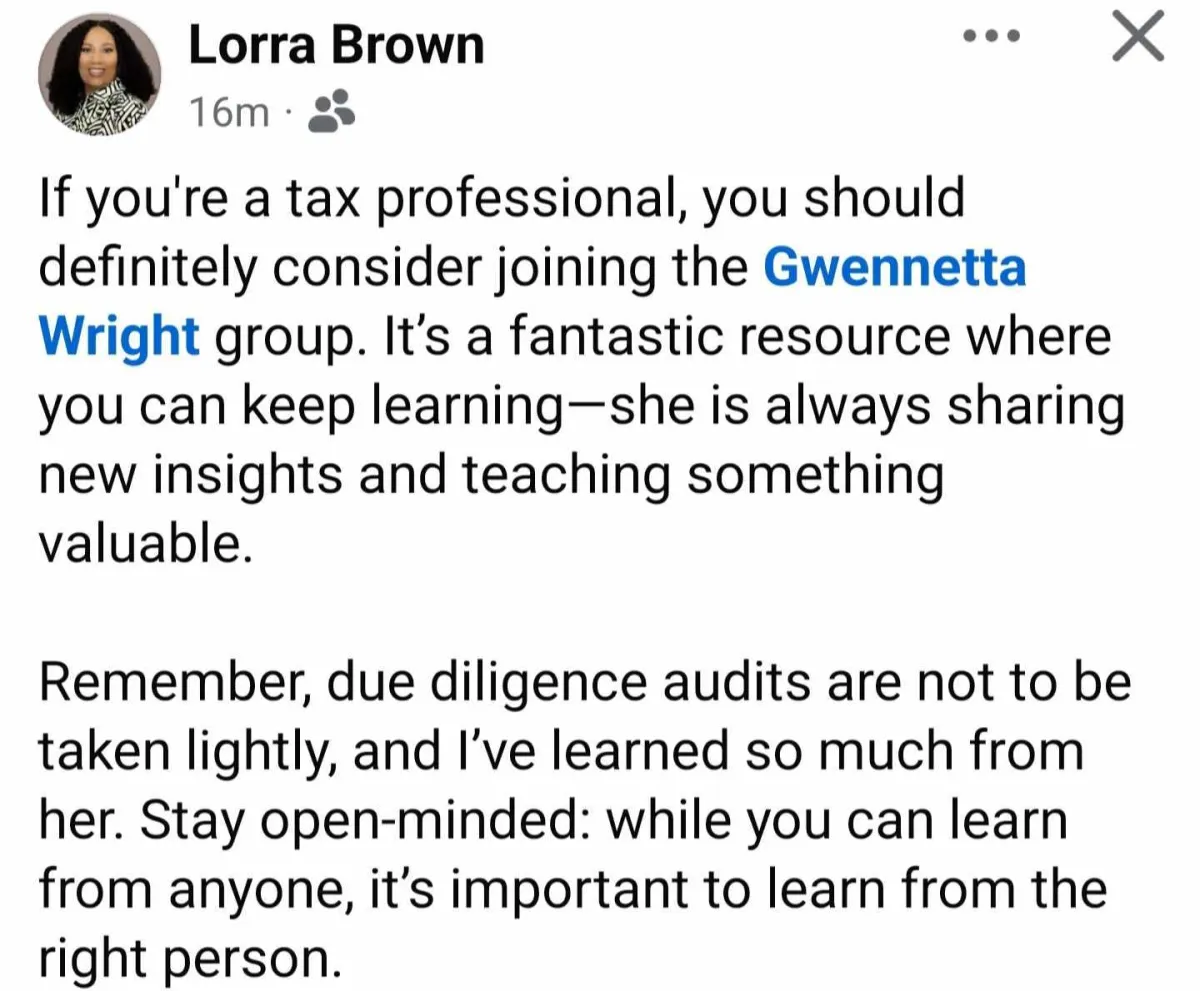

"I've learned so much from her."

If you're a tax professional, you should definitely consider joining the Gwennetta Wright group. It's a fantastic resource where you can keep learning-she is always sharing new insights and teaching something valuable. Remember, due diligence audits are not to be taken lightly, and I've learned so much from her. Stay open-minded: while you can learn from anyone, it's important to learn from the right person.

- Lorra Brown

"Deepened, Grateful, Inspired"

I have never learned as much as I did during this boot camp thank you so much for pouring into us.

- Lisla Wesley-Bryant

Are you ready if the IRS came knocking today?

Most tax pros aren’t. Missing notes, weak documentation, and sloppy files lead to thousands of penalties every single year.

One mistake can cost you $2,600 per return.

Most tax pros aren’t. Missing notes, weak documentation, and sloppy files lead to thousands of penalties every single year.

One mistake can cost you

$2,600 per return.

Are you ready if the IRS came knocking today?

Most tax pros aren’t. Missing notes, weak documentation, and sloppy files

lead to thousands of penalties every single year.

Most tax pros aren’t. Missing notes, weak documentation, and sloppy files lead to thousands of penalties every single year.

One mistake can cost you $2,600 per return.

One mistake can cost you

$2,600 per return.

That’s exactly why I created the Tax Pro Due Diligence Masterclass!

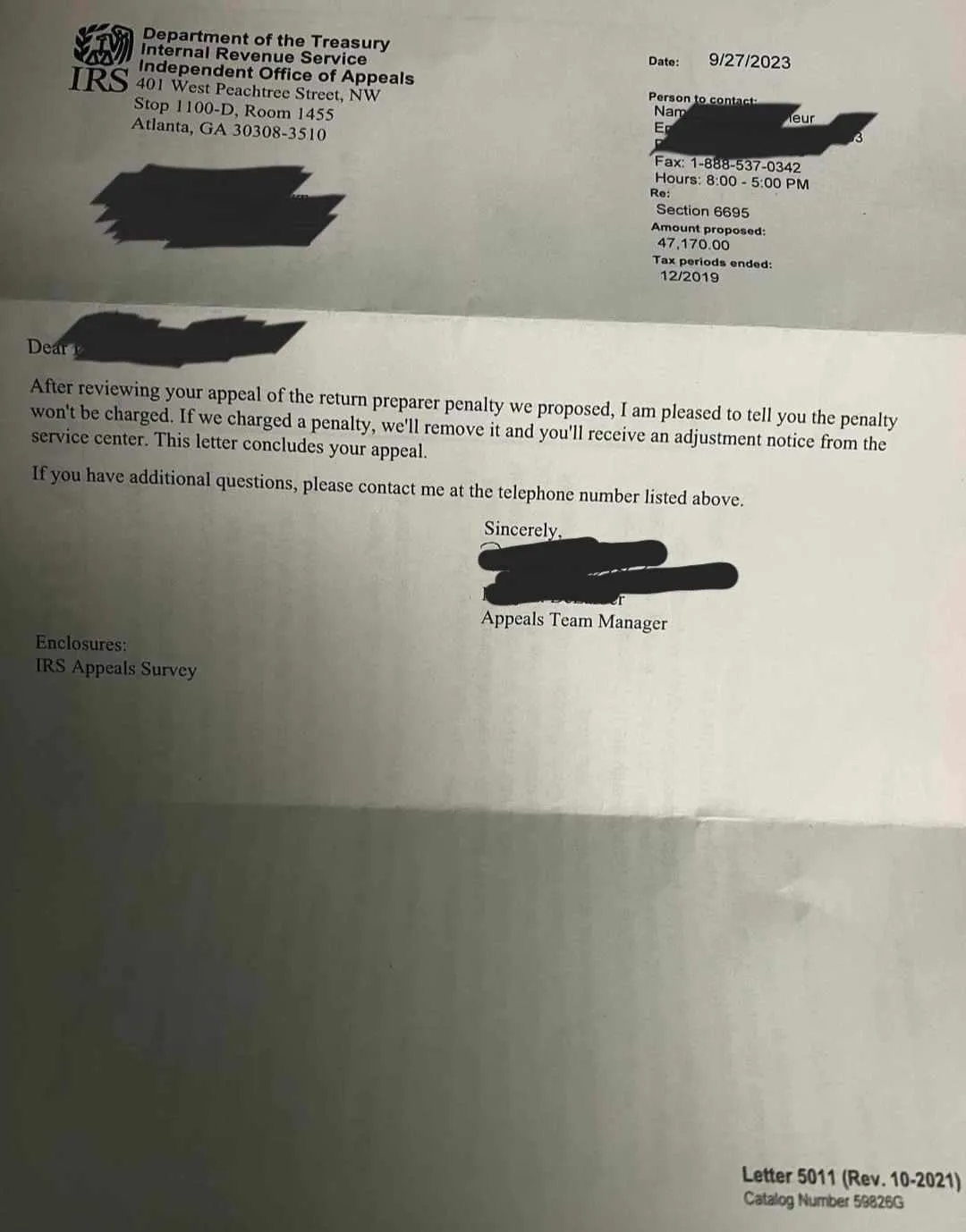

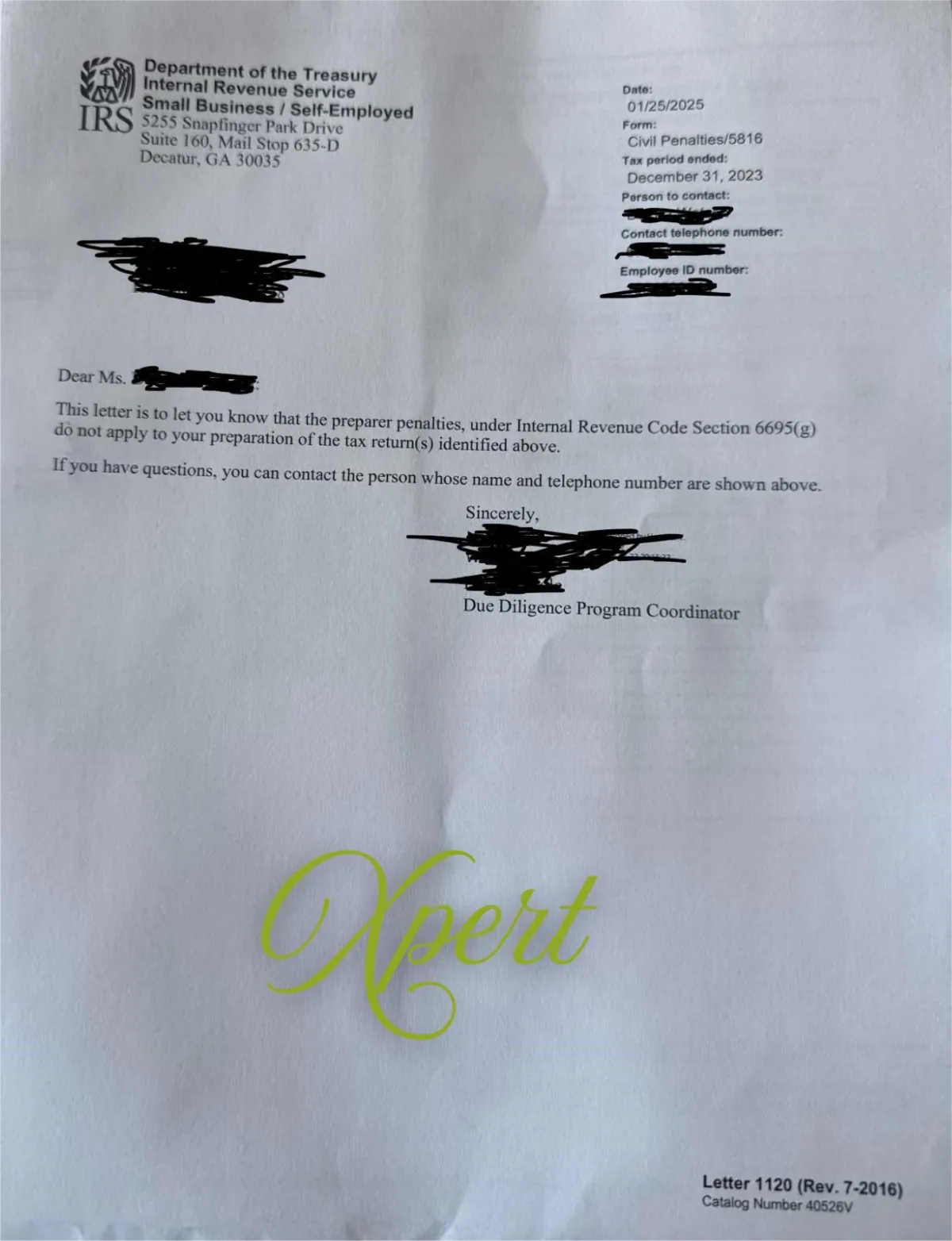

It’s the proven system I used for myself and my team to pass 8 IRS Due Diligence Examinations with zero fines, including appeals that knocked out penalties as high as $47,000.

$299 → $79

That’s exactly why I created the

Tax Pro Due Diligence Masterclass!

It’s the proven system I used for myself and my team to pass 8 IRS Due Diligence Examinations with zero fines, including appeals that knocked out penalties as high as $47,000.

$299 → $79

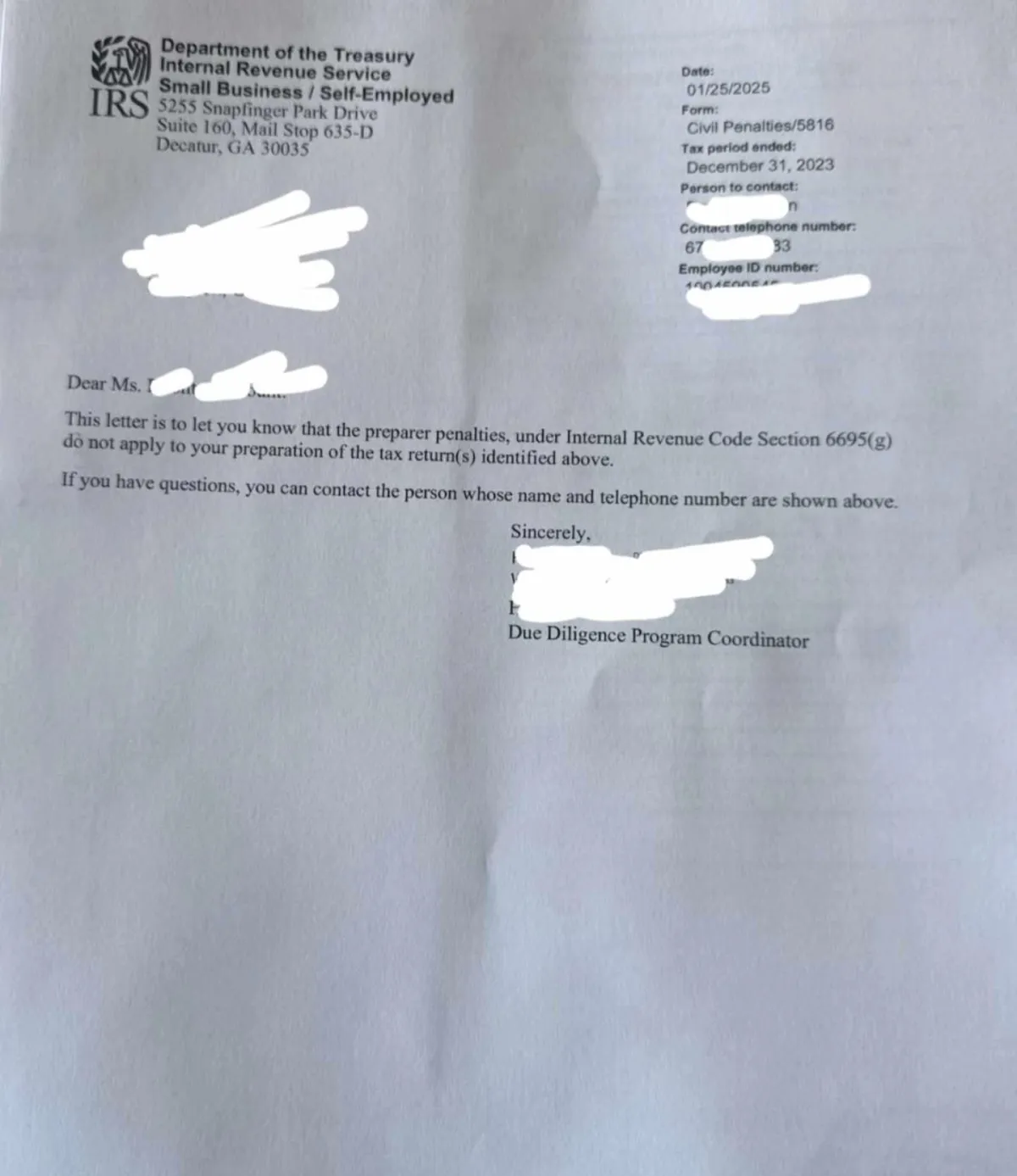

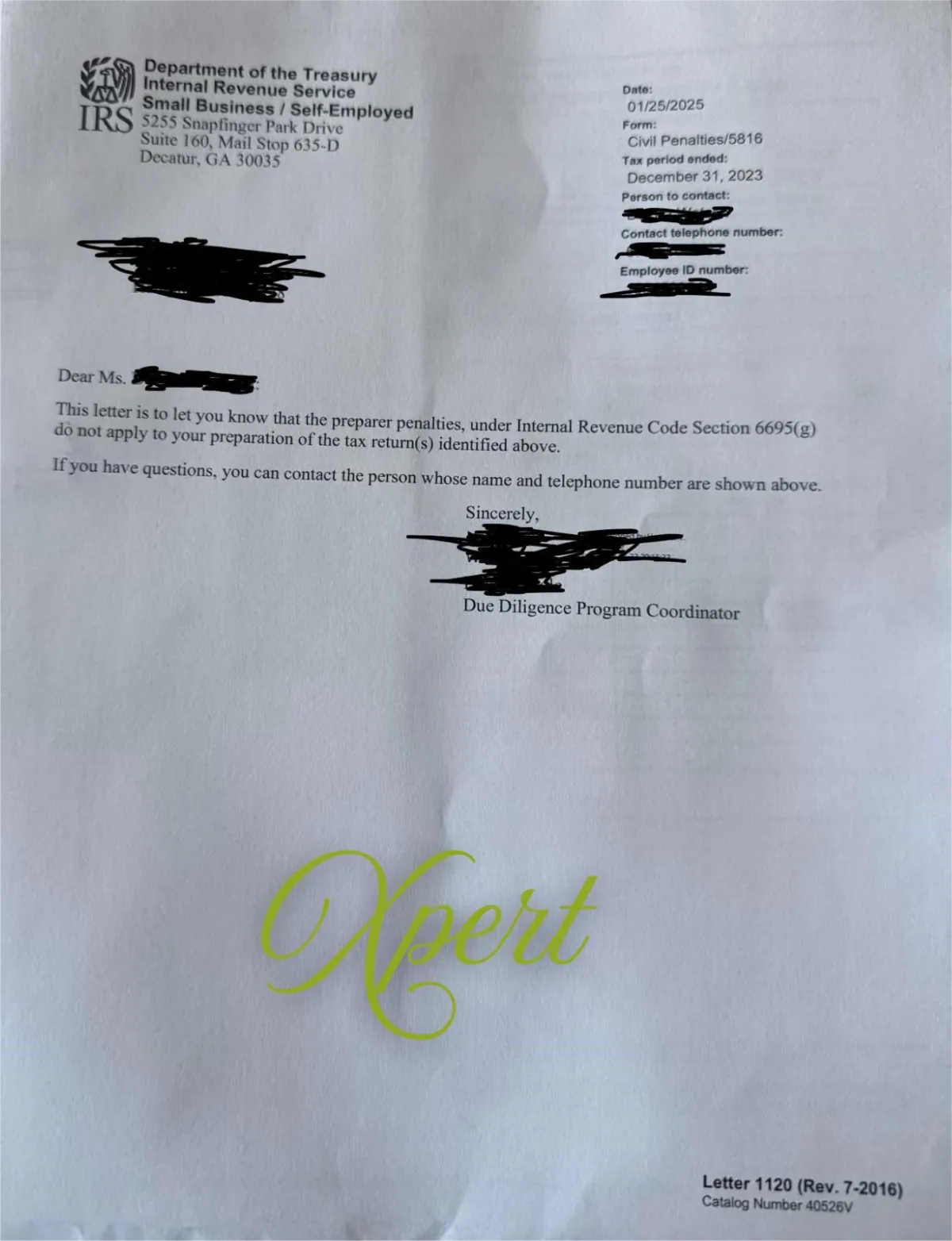

Proven Results

Helping Tax Pros Stay Compliant and Fine-Free!

Verified by the IRS

Proven Results: Helping Tax Pros Stay

Compliant and Fine-Free!

Proven Results: Helping Tax Pros Stay Compliant and Fine-Free!

Verified by the IRS

What You’ll Learn Inside the Masterclass

This masterclass is practical, straightforward, and built for real tax pros who want to stay in business, stay compliant, and stay profitable.

This masterclass is practical, straightforward, and built for real tax pros who want to stay in business, stay compliant, and stay profitable.

The 4 Due Diligence Requirements every tax pro must follow

Exactly what the IRS is looking for when they review your files

How to ask better questions and write stronger notes that stand up in an audit

Red flags that trigger penalties—and how to address them on the spot

File-building best practices so you’re always audit-ready

What You’ll Learn Inside the Masterclass

This masterclass is practical, straightforward, and built for real tax pros who want to stay in business, stay compliant, and stay profitable.

1

The 4 Due Diligence Requirements every tax pro must follow

2

Exactly what the IRS is looking for when they review your files

3

How to ask better questions and write stronger notes that stand up in an audit

4

Red flags that trigger penalties—and how to address them on the spot

5

File-building best practices so you’re always audit-ready

Why You Can’t Afford to Skip This

IRS penalties add up fast

Just 25 returns done incorrectly could cost you $65,000+ in fines.

Your EFIN and reputation are on the line

Non-compliance doesn’t just cost money—it puts your entire business at risk.

Knowledge is your defense

The IRS doesn’t expect perfection, but they do expect proof. This training gives you that.

Pre-Black Friday Offer Ends Soon!

Right now, you can grab your seat for just $79.

Once this sale ends, the price goes back to $199.

Don’t wait for the IRS to send a letter.

Don’t risk thousands in penalties.

Get audit-ready now—before tax season starts.

Still Unsure?

These trainings have helped people in all kinds of roles and industries:

Will this work for me?

These trainings were built for three types of professionals who want to save time, impress clients, and grow their business with smart AI automations:

Coaches &

Consultants

For those who teach, guide, or advise—and want AI to help them scale their time, delivery, and expertise.

AI Freelancer

Content Creator

Funnel Designer

Virtual Assistant

Tech VA

Career Coach

Financial Educator

Relationship Coach

Digital Marketer

Self-Development Coach

Energy Healer

Video Editor

Bookkeeper

SEO Specialist

Customer Service Pro

Interior Designer

HR Consultant

Pinterest Manager

AI Prompt Writer

Creative Freelancer

Service Providers & Freelancers

Whether you build, write, design, manage, or support—these automations help you do more in less time (without more tools or VAs).

Online Business Manager

Social Media Manager

Digital Course Creator

Automation Specialist

Health Coach

Spiritual Mentor

Email Marketer

Operations Consultant

Community Builder

Web Designer

OBM

Wellness Practitioner

Accountability Coach

Life Coach

High-Ticket Closer

Creative Director

YouTube Strategist

Travel Planner

TikTok Manager

Event Planner

Digital Creators & Tech-Savvy Entrepreneurs

If you’re creating content, offers, or client results online—this bundle helps you productize, automate, and scale.

Marketing Strategist

Copywriter

Business Coach

Client Experience Consultant

Podcast Manager

Author or Blogger

Systems Designer

Sales Coach

Therapist or Counselor

Brand Designer

Project Manager

Online Educator

Intuitive Coach

Startup Founder

Course Support VA

Tech-Savvy Consultant

Client Delivery Lead

Niche Service Provider

MEET

Dr. Gwennetta Wright

Tax Compliance Coach | 8-Figure Taxpreneur | IRS Due Diligence Expert

With 21 years in the tax industry, Dr. Gwennetta Wright is a nationally recognized tax expert, business strategist, and compliance coach who has helped hundreds of tax professionals build profitable, audit-ready businesses.

She’s the CEO of Xpert Tax Service, an 8-figure company with multiple locations, and the founder of Xpert Taxpreneur Academy and Xpert Business Solution, where she trains tax pros on Due Diligence, ERO Compliance, Schedule C mastery, and IRS audit defense strategies.

Dr. Wright and her team has been through 8 IRS Due Diligence examinations with zero fines, and when the IRS attempted to fine her tax preparer $47,000, she successfully appealed it herself, reducing it to zero. That real experience is what sets her apart.

Now, she teaches the exact systems and documentation strategies that help her and her team pass every audit, so you can stay compliant, protect your business, and gain the confidence you need to grow without fear.

She’s been featured in over 50 media outlets and podcasts and has received more than 40 awards, including the 2023 Presidential Lifetime Achievement Award.

If you’re serious about running a professional, compliant, and profitable tax business, you’re in the right place.

Pre-Black Friday Offer

Ends Soon!

Right now, you can grab your seat for just $79.

Once this sale ends, the price goes back to $299.

Don’t wait for the IRS to send a letter.

Don’t risk thousands in penalties.

Get audit-ready now—before tax season starts.

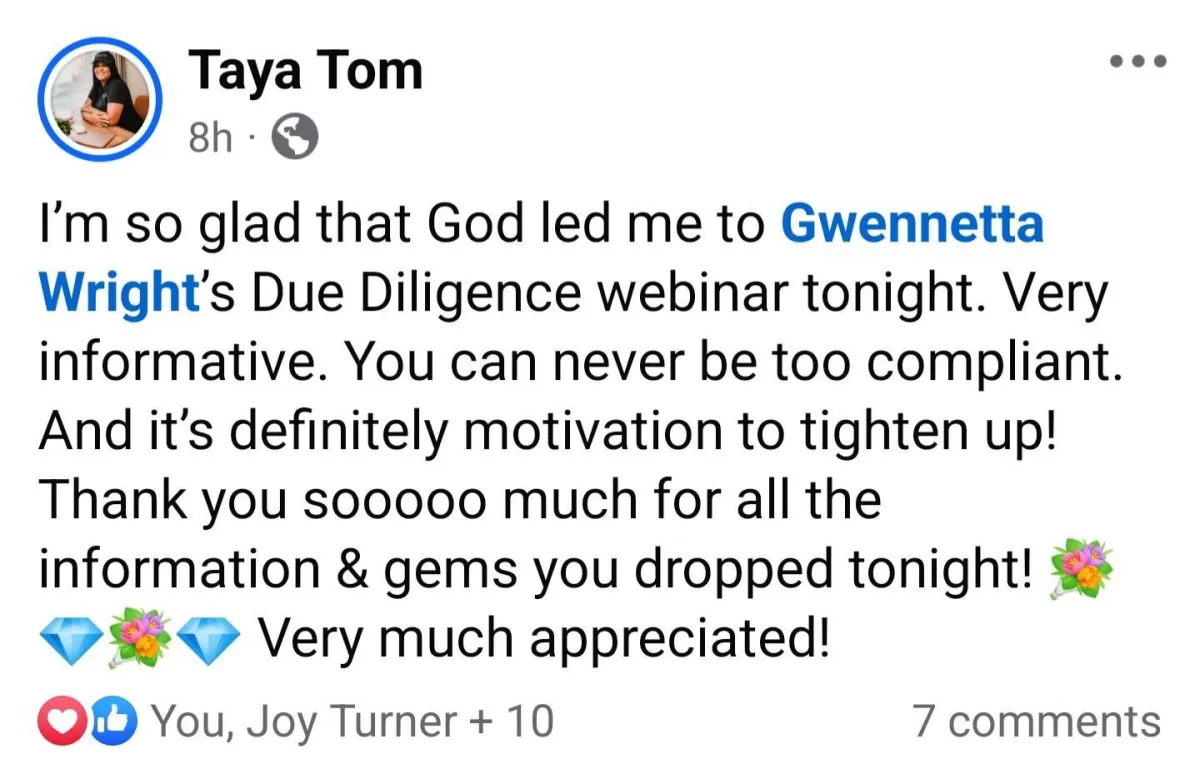

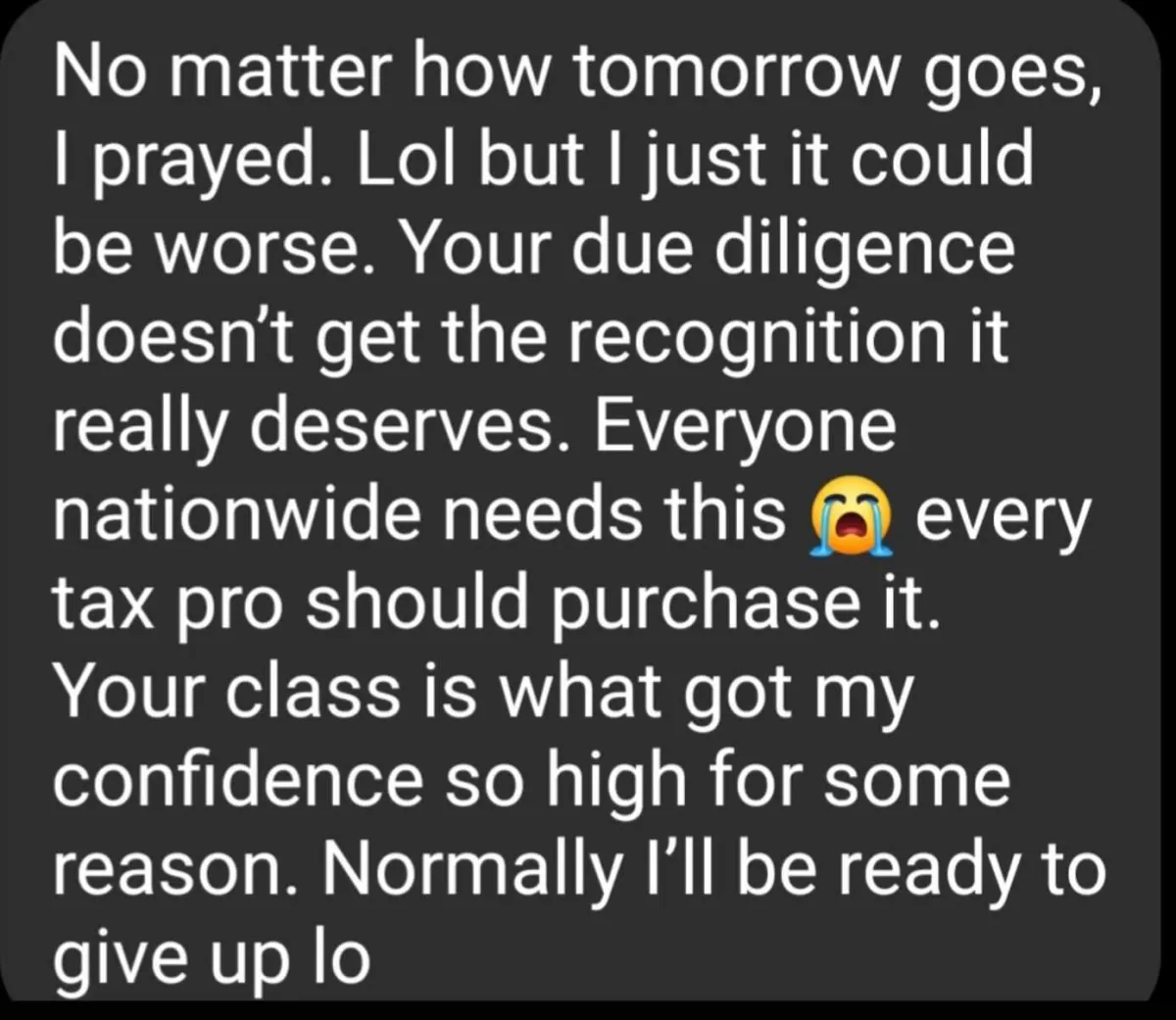

STRAIGHT FROM THE SOURCE

Hear directly how our Tax Pro Due Diligence Masterclass has empowered tax professionals to avoid fines, stay compliant, and protect their businesses with confidence.